Situation on the primary market in Poland after Q2 2025

Primary market in 2025: stabilization with potential

The second quarter of 2025 brings a number of important lessons for investors, apartment seekers and foreign buyers interested in buying property in Poland. Despite expectations of a robust rebound after interest rate declines, the primary market remains in a phase of stabilization. Key trends? Record supply, more demanding customers and strategic decisions by developers.

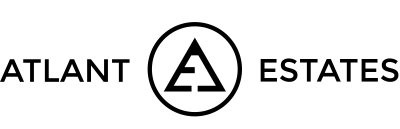

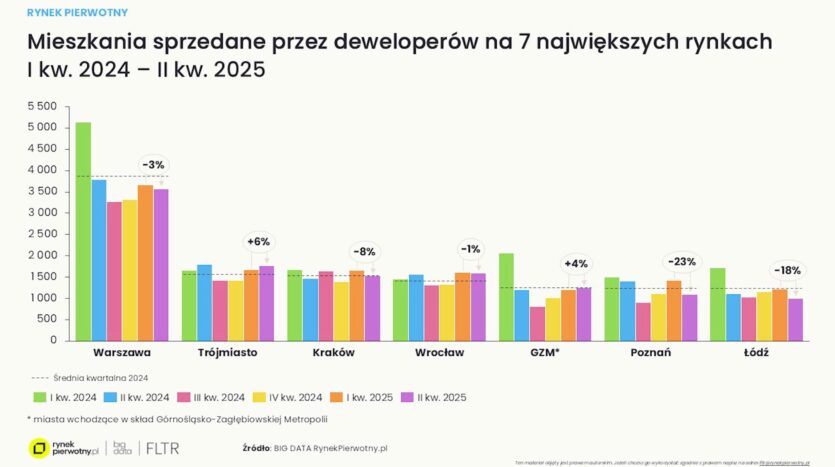

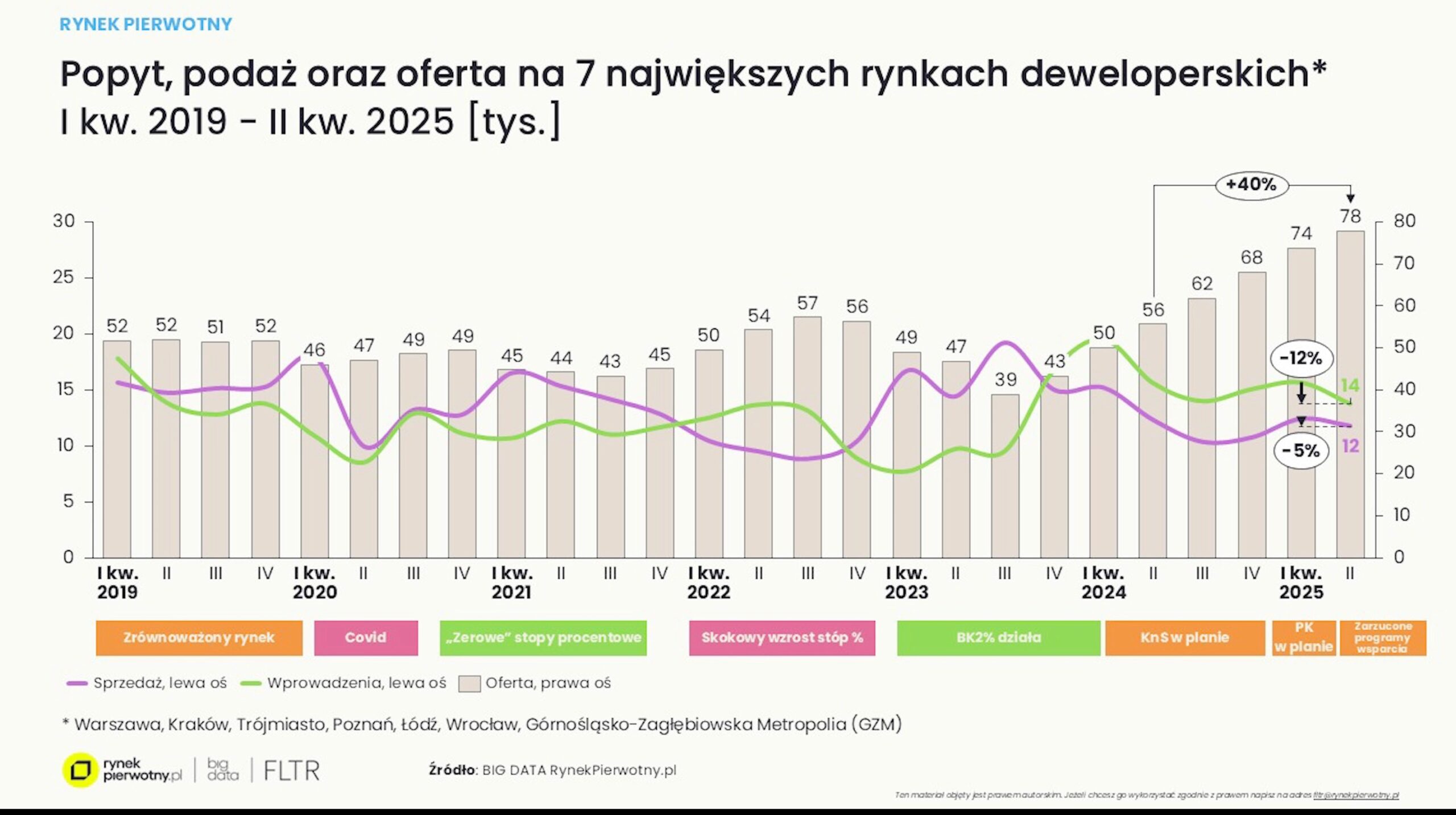

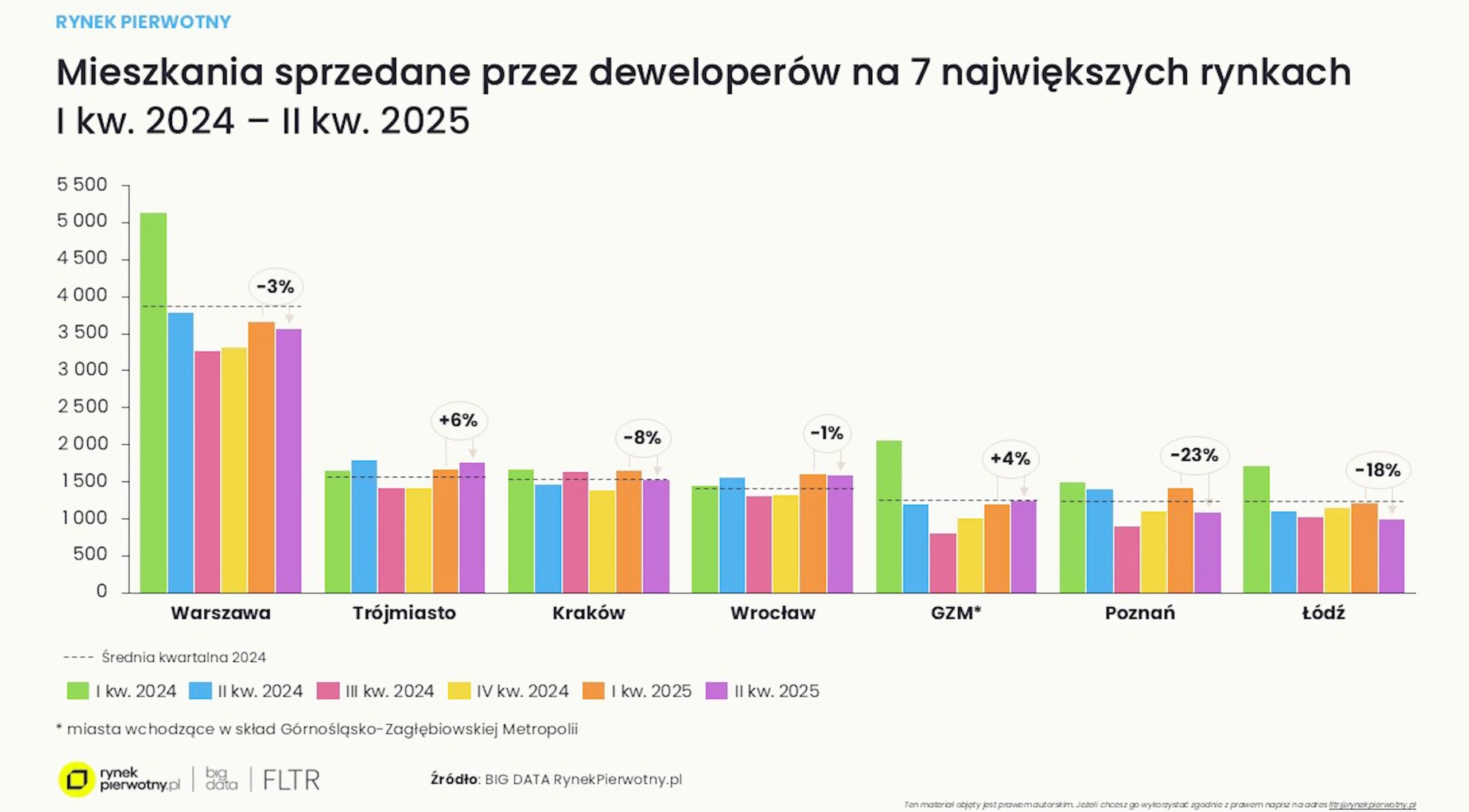

Key figures (7 largest markets)

- Number of units on offer: 78,000 (a record in the history of the primary market)

- Sales decline: -5% compared to Q1 2025 (moderate)

- Decline in new investments: -12% fewer new projects

- Top locations: Warsaw, Tricity, Krakow, Wroclaw

- ROI for investment units: 5.0-7.2% gross, depending on location

The market for the customer, not the developer

Key phenomenon: high supply

The increase in the offer is a result of the intensive launch of projects by developers in 2023-2024. Many investments have been introduced even from “spare” projects that were previously lying in a drawer. Today it is the customer who has the upper hand:

- Can compare the quality of projects and developers

- Doesn’t have to buy a “hole in the ground”

- Can expect added value: terraces, green spaces, amenities

- Customer does not act under the influence of FOMO and analyzes offers rationally

Conclusions for the investor:

- It’s not worth rushing into a purchase without analyzing the market

- Developers are ready to offer favorable terms to determined buyers

- Premium offers in locations with growth prospects are worth tracking

Where to buy apartments in Poland? Analysis of cities

Warsaw and Tricity

- Time to sell out: <5 quarters (balanced supply-demand relationship)

- Trends: stable prices, high quality offerings, growing importance of second home and premium segment

- Example ROI: 1-bedroom apartments Gdansk Downtown 6.5-7.2% gross

Krakow, Wroclaw, Poznan

- Time to sell out: 7-8 quarters (market requires better project selection)

- ROI: 5.5-6.2% gross on average

- Conclusion: it is worth investing in attractively priced apartments with good access and turnkey finishes

Łódź and GZM (Katowice and surroundings)

- Time of sale: 9-10 quarters

- Customer definitely dictates terms

- Investors can expect discounts, but must select projects by quality and location

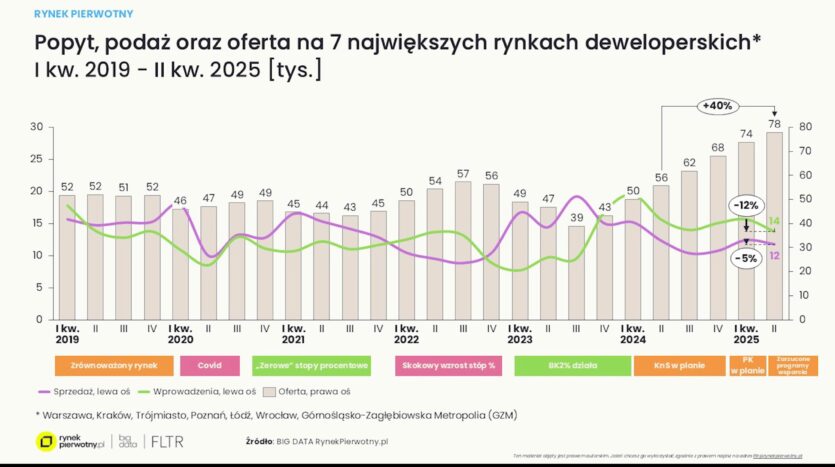

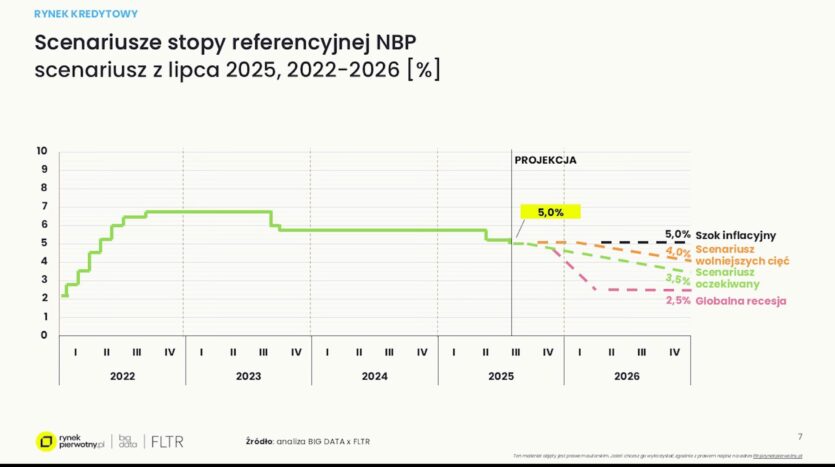

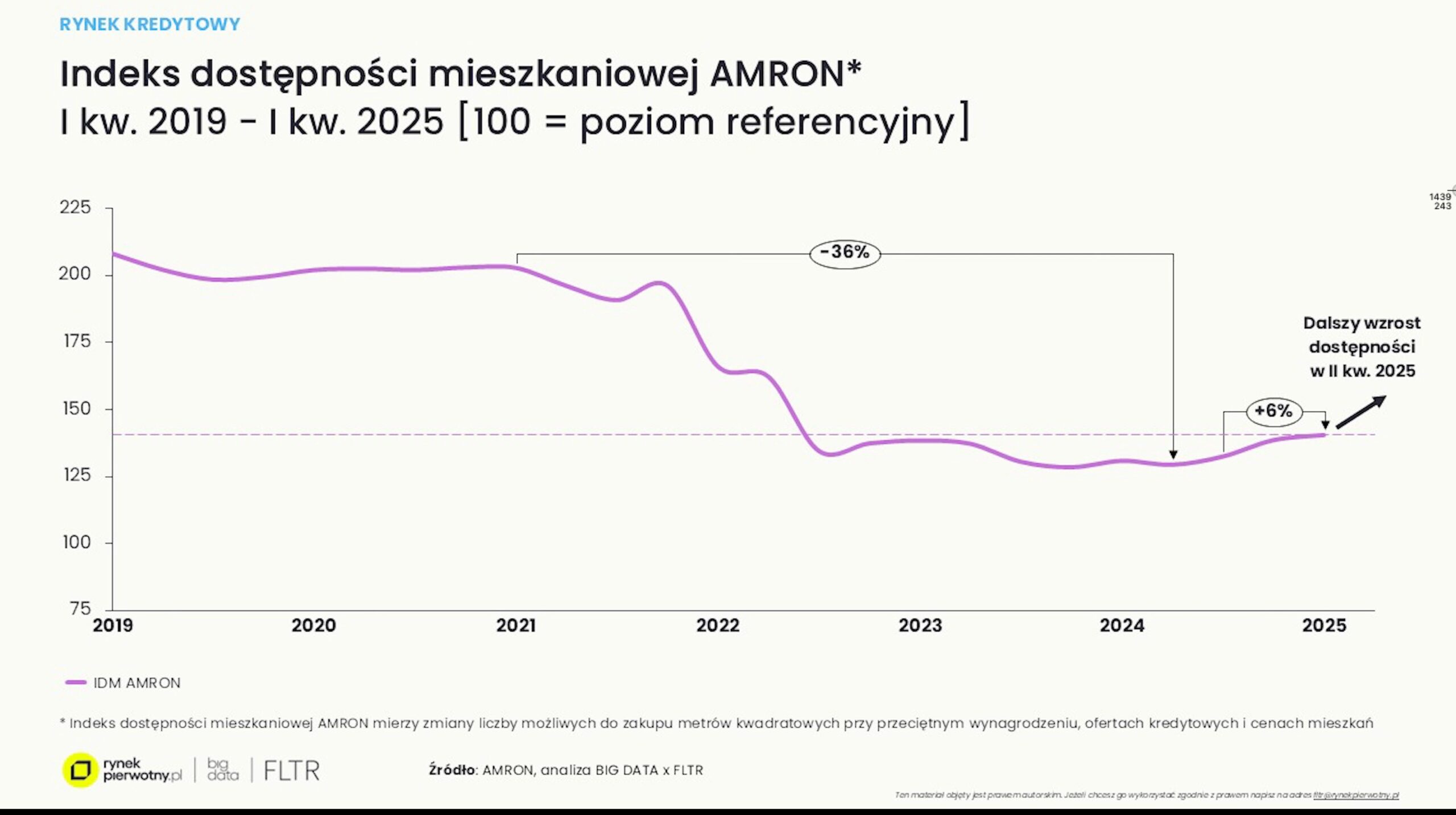

Mortgage loans and their impact on the market

Cost of financing

- Fixed-interest loans fell to 6% (from 7%)

- Creditworthiness increased by about 6% year-on-year, and by another 5% in the second quarter

- Customers have not yet returned en masse to the market – many expect further reductions

Typical customer questions:

- “Is it worth taking out a loan now, or waiting for rates to fall further?”

- “Can I afford a bigger apartment now that my capacity has increased?”

- “Won’t prices fall even further?”

Expert’s reply:

- Current conditions are relatively favorable, but no sudden impulse to buy

- Higher earners or couples with higher capacity take the most loans

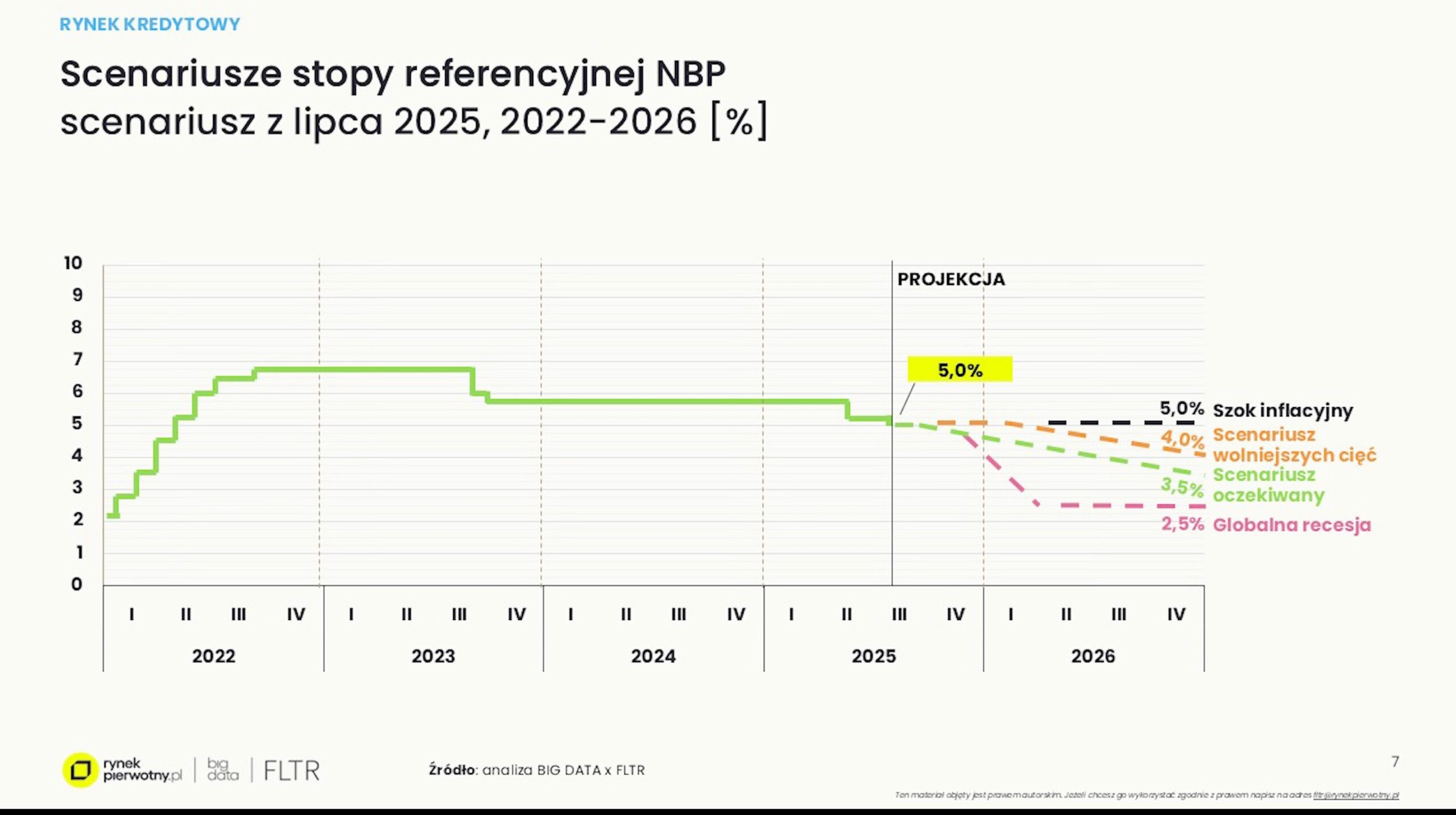

- Interest rates could fall to 4.5% by the end of 2025 and below 4% in 2026

- Customers often calculate: “since credit can be even cheaper, I’ll wait”.

Construction costs, land and supply challenges

Costs of investment implementation

- Average increase in material costs: +3% y/y

- Some elements are getting cheaper (OSB, wood), others are getting more expensive (energy, installations, wages)

- Skilled labor deficit may worsen in 2026-2027

Land: competition and price increases

- Share of land price in the project reaches 25-30%

- No new public land (government projects have not taken off)

- Developers enter joint ventures with private landowners

Outlook for 2026 and beyond

- Number of new construction permits drops sharply

- Possible supply gap: fewer projects = fewer bids = potential price increase

- Start of new investments held up by complexity of procedures and lack of available plots of land

How to buy an apartment on the primary market in Poland? [step by step procedure].

- Research the local market: compare selling time, ROI, price per sq ft

- Determine budget and creditworthiness: consult a credit counselor

- Choose a location: consider commuting, infrastructure, neighborhood development

- Rate the quality of the project: standard, common areas, surroundings

- Check documentation: permits, development agreement, prospectus

- Sign a reservation or development agreement

- Secure financing: loan, own funds, own contribution min. 10-20%

- Acceptance of the apartment and registration in the land register

Typical investor mistakes

- Purchase under the influence of emotions (e.g., “because the discount until the end of the week”).

- No analysis of ROI and hidden costs

- Misunderstanding of the development standard

- Failure to include land use plans

The future: quality and transparency as a competitive advantage

Companies like YIT are demonstrating that an approach based on Finnish values of transparency, design quality and the creation of living spaces (not just residential space) builds customer confidence. Publicly accessible pricing and additional amenities (integration zones, green terraces, communal recreation areas) are also increasingly important.

Summary and recommendations of Atlant Estates

What to remember:

- Poland’s primary market is entering a phase of rationalization and stabilization

- Project quality and locational advantages are key

- Credit is getting cheaper, but customers are buying more consciously

- Investments in Warsaw, Tri-City and Wroclaw have the best potential

Are you planning to buy an apartment on the primary market? Are you looking for an investment with a high ROI? Contact Atlant Estates experts and receive project analysis, credit recommendations and support in negotiations with the developer.

Call: +48 459 569 303

Email: office@atlantestates.com

Check current offers: www.atlantestates.com

Source: interviews with YIT CEO Leszek Stankiewicz published by RynekPierwotny.pl in July 2025 (Big Data analysis of the 7 largest housing markets).