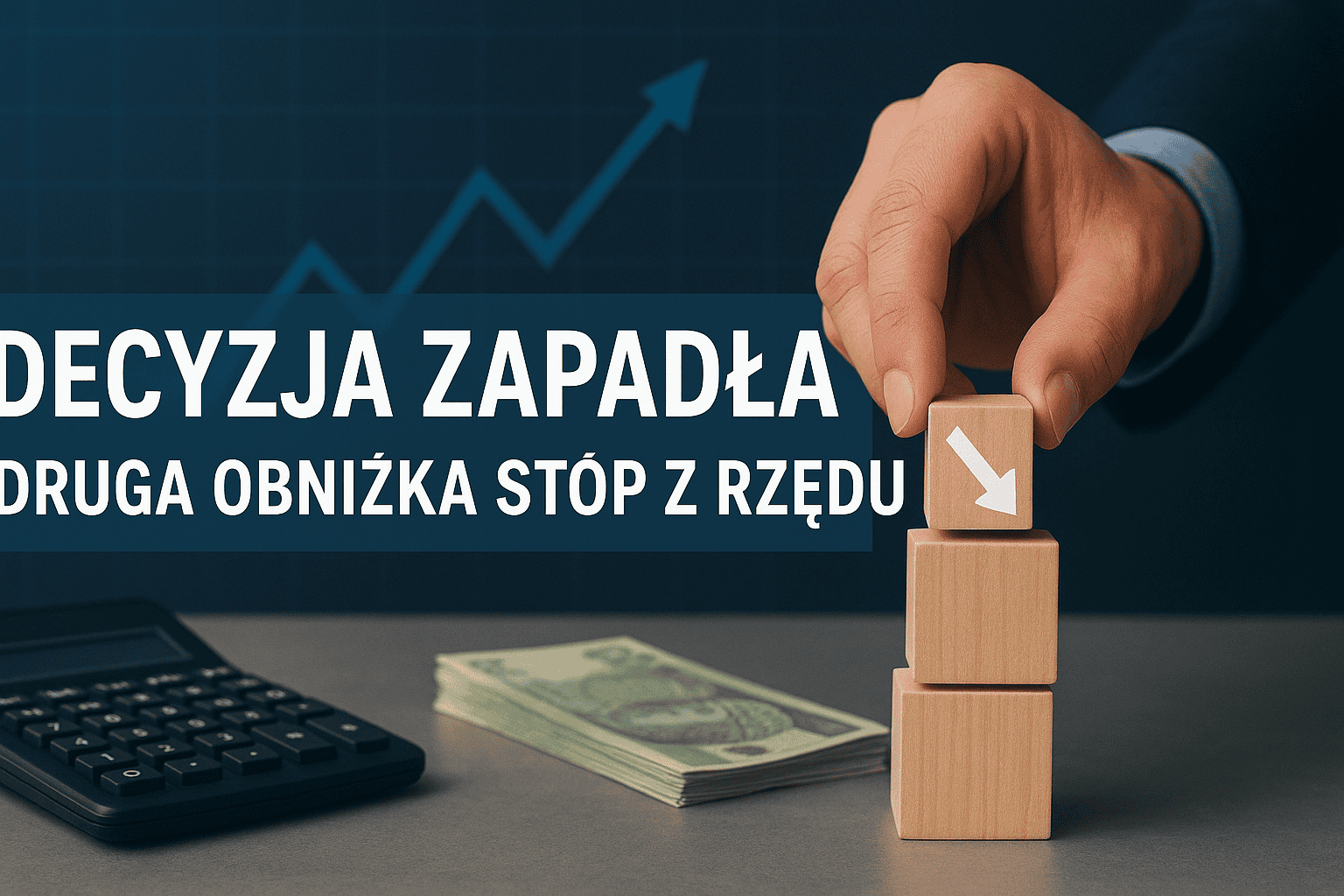

The decision has been made. Second rate cut in a row – what does it mean for the real estate market in Poland?

- Introduction: New impetus for investors and buyers

- What does the second interest rate cut mean?

- How does the rate cut affect the real estate market?

- Primary vs. secondary market – where is it better to invest?

- Typical mistakes of investors in the real estate market

- Is it a good time to buy real estate?

- Where is it worth investing in 2025?

- Prospects for the coming months

- Summary: It’s time to act

Introduction: New impetus for investors and buyers

In September, the Monetary Policy Council (MPC) decided to cut interest rates for the second consecutive month, this time by 0.25 percentage points. The main reference rate of the National Bank of Poland is now 4.75%.

This is a decision that has a significant impact on the real estate market in Poland – both for people planning to buy a home and investors looking for stable ways to invest capital.

Lower interest rates mean cheaper loans, greater availability of financing and, most importantly, a resurgence in demand for apartments for sale in Poland. For domestic and foreign investors, this signals that the time to invest in real estate may be now.

What does the second interest rate cut mean?

Why did the MPC make such a decision?

The Monetary Policy Council’s decision is due to several key factors:

- Falling inflation – CPI inflation is currently below 5%, which gives room for monetary easing.

- Economic slowdown – lower rates are expected to spur consumption and investment.

- An increase in the stability of the zloty – the reduction no longer causes such strong exchange rate fluctuations as in 2022-2023.

According to MPC members, the decision is expected to help households and businesses recover and increase their creditworthiness.

Current interest rate levels (October 2025)

| Type of foot | Level (%) |

|---|---|

| Reference | 4,75 |

| Lombard | 5,25 |

| Deposit | 4,25 |

| Rediscount of bills of exchange | 4,80 |

For borrowers and real estate investors, this is a tangible difference in financing costs that directly affects the profitability of housing purchases.

How does the rate cut affect the real estate market?

1. lower mortgage payments

Each reduction in interest rates translates into lower mortgage rates.

For example, the installment of a 500,000 zloty (25-year) loan has dropped by about 200 zloty per month in 2025 after two rate cuts. This increases the number of people who can afford to buy an apartment – which naturally drives demand.

Example:

In 2022, the installment of a 500,000 PLN loan was about 4300 PLN.

Today, at a rate of 4.75%, it is already 3700-3800 zlotys, depending on the bank.

2. Increased interest in buying

After the first rate cut in September, the number of inquiries for apartments for sale in Poland increased by 18% during the month (Otodom, NBP data).

The highest interest was in properties in:

- Warsaw,

- Cracow,

- Gdansk,

- Wroclaw,

- Lodz.

These cities are also seeing an increase in transactions in the secondary market, which has regained its appeal after a period of stagnation.

3. Housing prices – stabilization or growth?

Atlant Estates experts predict that after two interest rate cuts, housing prices in major metropolitan areas will begin to rise again.

The estimated increase for 2025 is:

- Warsaw: +5-6%

- Cracow: +4%

- Wrocław: +3-4%

- Gdansk: +5%

This trend is due to growing demand and a limited supply of new development projects.

Primary vs secondary market – where is it better to invest?

Primary market – security and modernity

New residential developments offer:

- Higher energy standards (saving up to 30% on bills),

- better location (close to business centers and transportation),

- developer’s warranty (5 years).

Prices in the primary market (Q4 2025):

- Warsaw: from PLN 14,000/m²

- Kraków: from PLN 12,500/m²

- Gdańsk: from PLN 11,000/m²

- Poznań: from PLN 9,500/m²

For foreign investors, such as those from Germany or Scandinavia, these are still attractive price levels compared to Western Europe.

Secondary market – investment opportunities

You can find apartments on the secondary market:

- With a good location in the center,

- Often at a lower price per m²,

- available “off-the-shelf”.

Average prices on the secondary market:

- Cracow: from PLN 8,500/m²

- Łódź: from PLN 6,500/m²

- Katowice: from PLN 7,000/m²

This is a segment that yields a higher potential ROI (Return on Investment) – as much as 7-8% per year for long-term rentals.

Typical mistakes of real estate investors

1. Driven solely by price

A cheap apartment does not always mean a good investment. Location, rental demand, building condition and communication are key.

2. No exit strategy

Some investors do not plan what they will do with the property if market conditions change.

A good agency, such as Atlant Estates, will help select an apartment for a specific purpose – rent, flip, or long-term profit.

3. Underestimation of costs

Buyers often overlook:

- Notary fees (about 2% of the value),

- PCC tax (2%),

- Bank commission (1-2%),

- Finishing (on average PLN 1500-2500/m²).

4. No ROI analysis

Every investment should be counted. For example:

- An apartment in Lodz for 400,000 zlotys,

- Rent of 2500 zł/month,

- annual revenue: PLN 30,000 → ROI = 7.5%.

Is it a good time to buy property?

From an economic and financial point of view – yes.

Here’s why:

- Decrease in financing costs – mortgage cheaper by about 0.5 percentage points than six months ago.

- Increased demand – especially among first-time home buyers and investors from abroad.

- Safe investment of capital – apartments in Poland offer a higher ROI (5-7%) than deposits or bonds.

- Potential price increases – with growing demand and limited supply.

Where is it worth investing in 2025?

Warsaw – the center of business and capital

- Average price: PLN 14,500/m²

- ROI: 5-6%

- Demand: high – for both long-term and corporate rentals.

- The most attractive districts: Mokotów, Wola, Żoliborz.

Krakow – stability and tourism

- Average price: PLN 12,800/m²

- ROI: up to 7%

- Large market for short-term and student rentals.

- Popular locations: Old Town, Grzegórzki, Zabłocie.

Wroclaw – a dynamic IT center

- Average price: PLN 11,900/m²

- ROI: 6-6.5%

- Growing demand for housing for technology workers.

- Recommended areas: Krzyki, Psie Pole, Fabryczna.

Łódź – the future of development

- Average price: 7,000 PLN/m²

- ROI: 7-8%

- Infrastructure investments (New Center of Lodz, cross-town tunnel) increase profit potential.

- Districts worth noting: Polesie, Downtown, Widzew.

Outlook for the coming months

Analysts predict that another symbolic interest rate cut is possible in 2025.

This will mean a further recovery of the market, and with it – an increase in property values of 3-6% per year.

As a result:

- There is growing interest in investments in smaller apartments (35-55 sqm),

- Developers resume projects put on hold in 2023,

- Banks have eased credit requirements, increasing the availability of financing.

For investors, this is the perfect time to enter the market – before prices peak again.

Summary: Time to act

The second interest rate cut is not just a central bank decision – it’s a turning point for the Polish real estate market.

Lower loan repayments, greater demand and growing interest from foreign investors mean that Poland remains one of the most stable and profitable markets in Central Europe.

🏡 Invest with Atlant Estates

If you are looking for:

- apartments for sale in Poland,

- A safe investment with a high ROI,

- Professional support in English or Ukrainian –

Atlant Estates will help you find the perfect property and guide you through the entire buying process.