New tax obligations for property owners – what’s changing?

Recently, there have been increasing reports in the media about changes to the tax obligations of owners of privately rented property. While many of these regulations primarily affect VAT taxpayers, the changes may also affect those who enjoy exemptions today. Here’s what you should know and how to prepare.

1. Property owner as a VAT payer

According to the regulations, a person who rents a property – even as a private rental – acquires the status of a VAT taxpayer (although often an exempt entity).

– In practice, private rental for residential purposes enjoys a subject exemption (Article 43(1) of the VAT Act) – which means that the service is exempt from VAT and the owner does not have to issue an invoice, unless the tenant (e.g., a company) requests a document.

– There is also a subjective exemption – when the income from the business (including rental) does not exceed a certain limit (until the end of 2025 – PLN 200,000, thereafter PLN 240,000) – then the owner does not become an active VAT taxpayer.

– If the owner is an active VAT taxpayer and rents the property to a company (B2B), he is required to issue an invoice in accordance with VAT regulations.

These rules are currently in place – but starting in 2026, a key change will come in the form of an obligation to use the KSeF system (National e-Invoicing System), which may also affect owners using the exemptions.

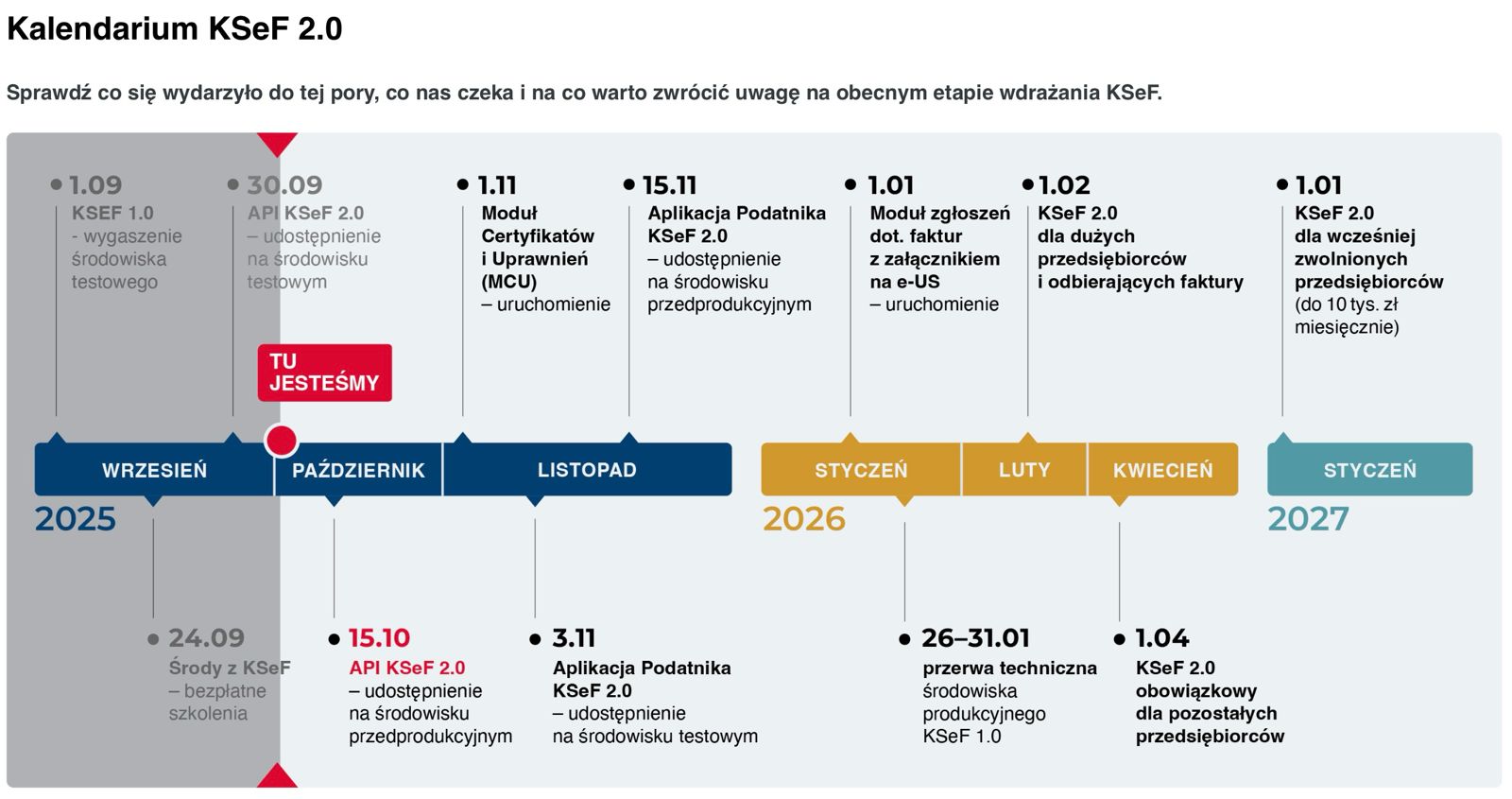

2. KSeF (e-invoicing) – new mandatory framework

KSeF is a central electronic system that handles structured invoices. Until now, many people thought that these changes did not apply to them, but the situation is beginning to change.

Key dates and scope:

– The obligation for KSeF to receive invoices will apply to all taxpayers as early as February 1, 2026.

– The obligation for KSeF to issue invoices will apply to other taxpayers starting April 1, 2026, including landlords.

– Micro-taxpayers issuing low-value invoices (gross ≤£10,000 per month) may have a transitional period (or exemption) in the first year of application, although this mainly applies to sales, not rentals.

What this means in practice:

– Even owners who are exempt from VAT today will have to use KSeF if they issue invoices (e.g., for businesses).

– In the case of renting to an individual (B2C): named invoices (or bills) will not be covered by the mandatory KSeF – the landlord can issue a document outside the system if the tenant requests it.

– If the landlord does not have a TIN number (and has previously settled on PESEL), in order to issue an invoice via KSeF for a B2B tenant, the landlord will need to obtain a TIN.

– Regarding cost invoices (e.g., utilities) – when suppliers will use KSeF, to receive such an invoice, the owner must be visible in the system as an exempt VAT taxpayer.

3. Practical scenarios – what you need to know as an owner

Scenario A: private rental (B2C), apartment for residential purposes

– Most often you benefit from the subject exemption – you do not need to issue an invoice or use KSeF.

– If the tenant (an individual) asks for a document – you can issue a regular bill or a named invoice outside KSeF (until the system becomes mandatory).

– When the KSeF invoicing obligation (for B2C) arrives – this case will be covered by statutory exceptions.

Scenario B: rent to a company (B2B)

– If you are an active VAT taxpayer: you issue invoices, preferably immediately with integration with KSeF.

– If you are exempt: until 2026 you do not have to issue invoices, but when the tenant requests a document – it will have to be issued by KSeF.

– In practice – from April 1, 2026, B2B property owners will have to use the system.

Scenario C: issuing cost invoices (utilities, services)

– Suppliers will increasingly use KSeF – when the owner wants to receive an invoice in KSeF, he must be a VAT payer (exempt or active) and have a TIN.

– If the owner does not provide a TIN, the supplier can issue a regular invoice outside the system, but in the long run the lack of presence in the KSeF system can be problematic.

4 Penalties and transition periods

– The law stipulates that a taxpayer who issues a structured invoice outside the KSeF (when he should be using the system) can be fined up to 100% of the tax amount or 18.7% of the value of the amount due (in the case of an exemption).

– However, no penalties will be imposed in the first year of the system’s operation.

– The obligation to issue e-invoices in KSeF will apply to all VAT taxpayers (active and exempt) – although the deadline for micro-entrepreneurs is only scheduled for January 1, 2027 (with sales of less than PLN 10,000 gross per month).

5. What to do today to be ready?

1) Check whether your tenants are companies or individuals – this determines whether your documents will require a KSeF.

2) If you don’t have a TIN yet – consider getting one, especially if you rent to companies.

3. Get an accounting program or property management system that has KSeF integration.

4. Be prepared to accept cost invoices – notify utility suppliers that you are a VAT-exempt taxpayer.

5. Keep track of announcements from the Ministry of Finance and tax offices – KSeF regulations can evolve.

Summary

Changes in VAT and KSeF invoicing obligations in the coming years may also affect owners of privately rented properties. While in many cases exemptions will protect against the obligations, owners who work with companies should prepare for the need to use the system, obtain a TIN and upgrade their invoice handling.

If you want a customized analysis, tailored to your situation as a property owner or investor – contact Atlant Estates.